Both trading and investing aim to grow your money—but they’re very different in nature. Think of investing as running a marathon and trading as running sprints.

You can succeed with either method, and even blend both with your available capital. We’ll go through the key differences of each to help you decide which style suits you.

Investing: Buying assets to hold for years to profit from compounding over time.

Trading: Buying and selling frequently to exploit shorter-term price moves.

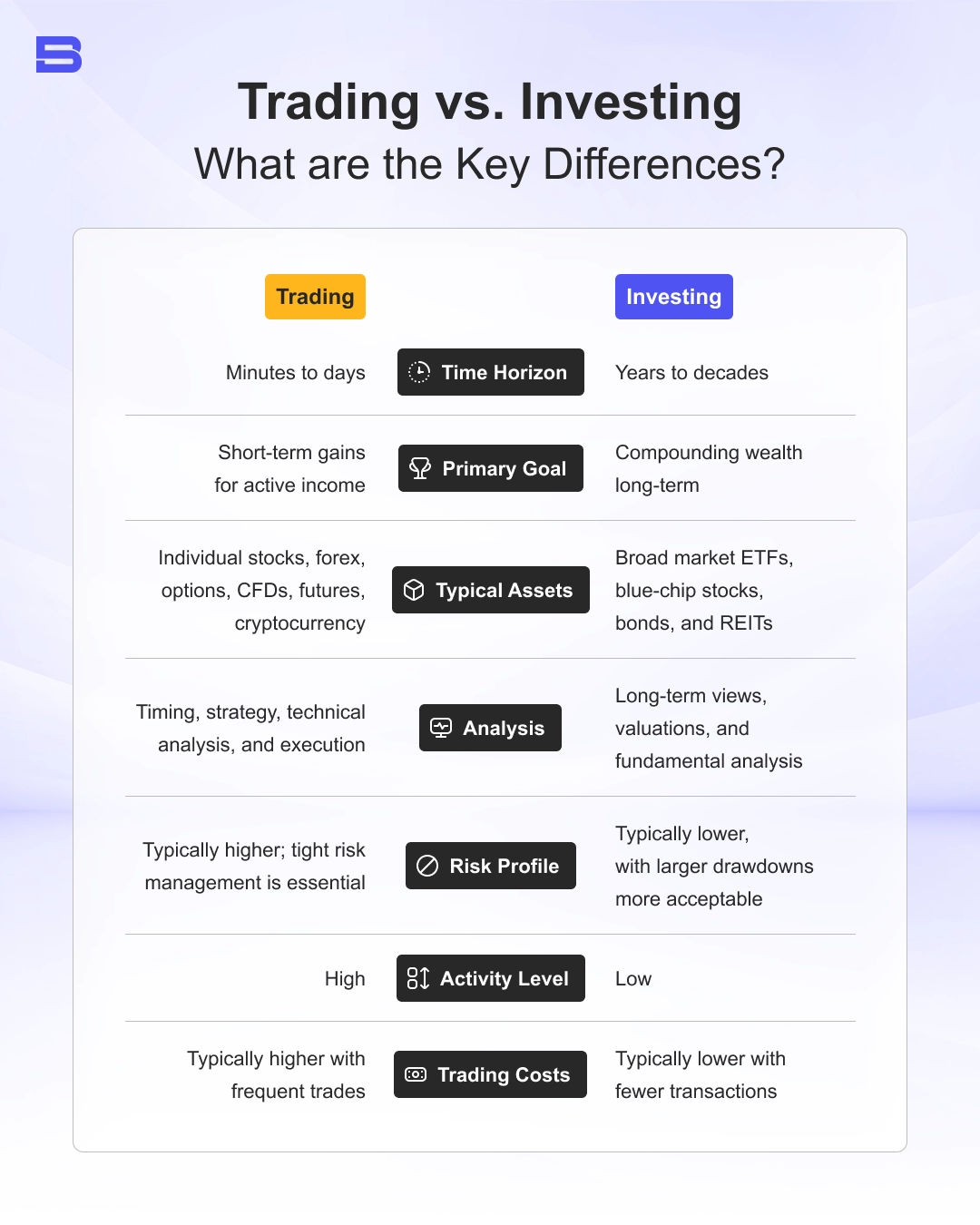

How do you know which one works for you? Here’s a quick comparison:

Now, let’s dive into the details and considerations to make a case for each method, so you can decide which suits you best.

Goals and Time Horizon

Investing aligns with big-picture goals, such as retirement, purchasing a home, or funding your children’s college education. These goals typically require large capital and a longer time horizon. As a long-term investor, you’re willing to accept short-term volatility now for a higher expected payoff later.

Trading, on the other hand, targets short-term profits by executing more frequently, compounding small edges. The aim is to control risk tightly and avoid large drawdowns. Setting clear and realistic goals daily or weekly and sticking to them is crucial before getting started with trading. Traders primarily aim to increase their monthly income by consistently making profitable trades.

Decision-Making Process

The methods drastically diverge when it comes to making decisions. Investors typically study fundamentals and valuations, focusing on long-term views. They often use dollar-cost averaging and rebalance their portfolios over time.

Traders focus on market behavior such as trends, support and resistance levels, momentum, and news catalysts. They use predefined setups, risk limits, and execution rules to make informed trading decisions.

Risk and Money Management

Investors and traders will manage their money and risk differently as well. Diversification and asset allocation are key to wealth management in the long run. Investors manage risk by balancing different asset classes and staying invested through market cycles. This attitude is exemplified by the classic Kenneth Fisher mantra, “Time in the market beats timing the market.”

Traders, on the other hand, must utilize proper timing, position sizing, stop losses, and loss limits to stay in the game. Their edge is measured with stats such as win rate, risk-reward ratio, and maximum drawdown.

Expectations and Market Edge

It’s important to have realistic expectations of returns with both methods. Investing typically leans on compounding growth from reinvested dividends and capital appreciation over time. The market edge of an investor is rooted in strong fundamental analysis and the patience to ride the volatility of the investment.

Since traders rely on short-term moves, their market edge comes from consistently executing a winning strategy while keeping losses small. Powerful technical analysis and pattern recognition are a trader’s bread and butter.

Trading Costs

For investors, fewer trades mean lower costs. This usually results in lower taxes when investments are held long-term, as profits are considered capital gains.

Traders execute trades more frequently and thus have to pay more in commissions and other trading costs. This may result in higher taxes on profits as trading is considered a form of income.

It’s important to know the tax implications of both investing and trading, as they differ according to each country’s respective laws.

Trading Psychology

Investing requires patience and discipline over years or even decades. The main challenge is resisting the urge to sell during downturns.

Investors need to handle short-term volatility without panicking, trust in long-term compounding, and stick to asset allocation even when the market is turbulent. Emotional resilience against fear in bear markets and greed in bull markets is crucial.

Trading requires quick decision-making and emotional control in the short term. The challenge is avoiding overtrading, cutting losses quickly, and sticking to setups without chasing moves.

Traders face more frequent losses, so they need to be comfortable with being wrong often while still executing rules consistently. Discipline and self-control are vital to separate emotions from execution. It’s easy to fall into impatience, revenge trading, or overconfidence, which can hamper profitability.

Personal Checklist

These are some questions you can ask yourself to figure out whether investing or trading is the right approach for you:

- What are your goals, and how much time will you need to achieve them?

- How much time do you have to dedicate to analysis every day or week?

- How much risk are you willing to take with your capital, and how will you react when things aren’t going your way?

- Do you prefer fundamental analysis or technical analysis?

Final Word

The characteristics outlined in this article aren’t strict rules; rather, they serve as guidelines. Many of the qualities discussed, such as emotional control, risk management, and decision-making between investing and trading, share many commonalities.

Trading and investing can be viewed as a continuum where various profitable strategies exist, from shorter-term strategies such as scalping and day trading to longer-term strategies, such as swing trading and long-term investing.

All of these strategies will require active learning and interpretation of the shifting market dynamics. Every market participant is free to speculate using whichever method suits them to find an edge and build wealth sustainably, but having a clear grasp of what trading is will make that journey far easier.