BrokerSpecs aims to help people invest smarter and make the right choices. We work diligently to deliver accurate, well-tested, and objective broker reviews to educate investors.

To achieve this, we consistently apply an equitable and transparent methodology for all our reviews and ratings. The BrokerSpecs team rigorously tests and fact-checks broker features, then applies a standard evaluation across the same key data points to arrive at the overall score.

Through this transparency, we ensure fairness and integrity in all of our broker reviews.

Every broker is evaluated across several key categories. Each one reflects an essential part of the trading experience:

This represents a priority concern for traders. High costs in the form of wide spreads or expensive trading commissions directly affect profitability, especially for high-frequency traders. We include all hidden fees and factor in any reward systems or discounts to provide a comprehensive outlook on the broker’s pricing competitiveness.

Strong regulation and investor protection are essential trust factors. We validate the regulatory licenses across all entities in our broker reviews and check for investor protection through compensation schemes, negative balance protection, and segregated client funds. We account for the industry experience, financial transparency, and insolvency risk of the reviewed brokers when formulating this score.

A broad range of tradable instruments across asset classes enhances flexibility, enables portfolio diversification, and meets the varying goals of traders. We validate the range of instruments, market access, and asset diversity to rate the broker’s product offering holistically.

A broad range of trading platforms enhances accessibility to a wide audience of traders. We evaluate the breadth of trading platforms available, along with their usability, reliability, and execution speed across different platforms—desktop, mobile, and web versions.

Frictionless, cost-effective funding and withdrawals are crucial for trust and fund management. A variety of methods and currency options provide convenience. Our rating considers the range of funding options available, the processing speed of deposits and withdrawals, any fees involved, and the overall clarity and transparency of these transactions from the broker.

The interface is important because it is where all the trading happens. The platforms should be intuitive, fast, stable, bug-free, and feature-rich to provide the best user experience. We test these platforms and examine them from these angles to effectively rate the overall trading experience provided by the broker.

Flexibility in account options caters to various trader profiles. Although this is a one-time process for most users, the type of account impacts the fees, trading options, market access, and more. We derive our score from the range of available account options and the features supported by those accounts.

This is particularly important for beginners as it provides the convenience of accessing educational materials and research tools on a single platform. We evaluate what the broker has to offer in terms of educational material, market analysis, insights, research tools, and more.

Support becomes critical during moments of platform or account issues. Otherwise, this service will not be used daily by most users. We test the support team through all channels and evaluate their responsiveness, availability, and the number of languages supported for convenience.

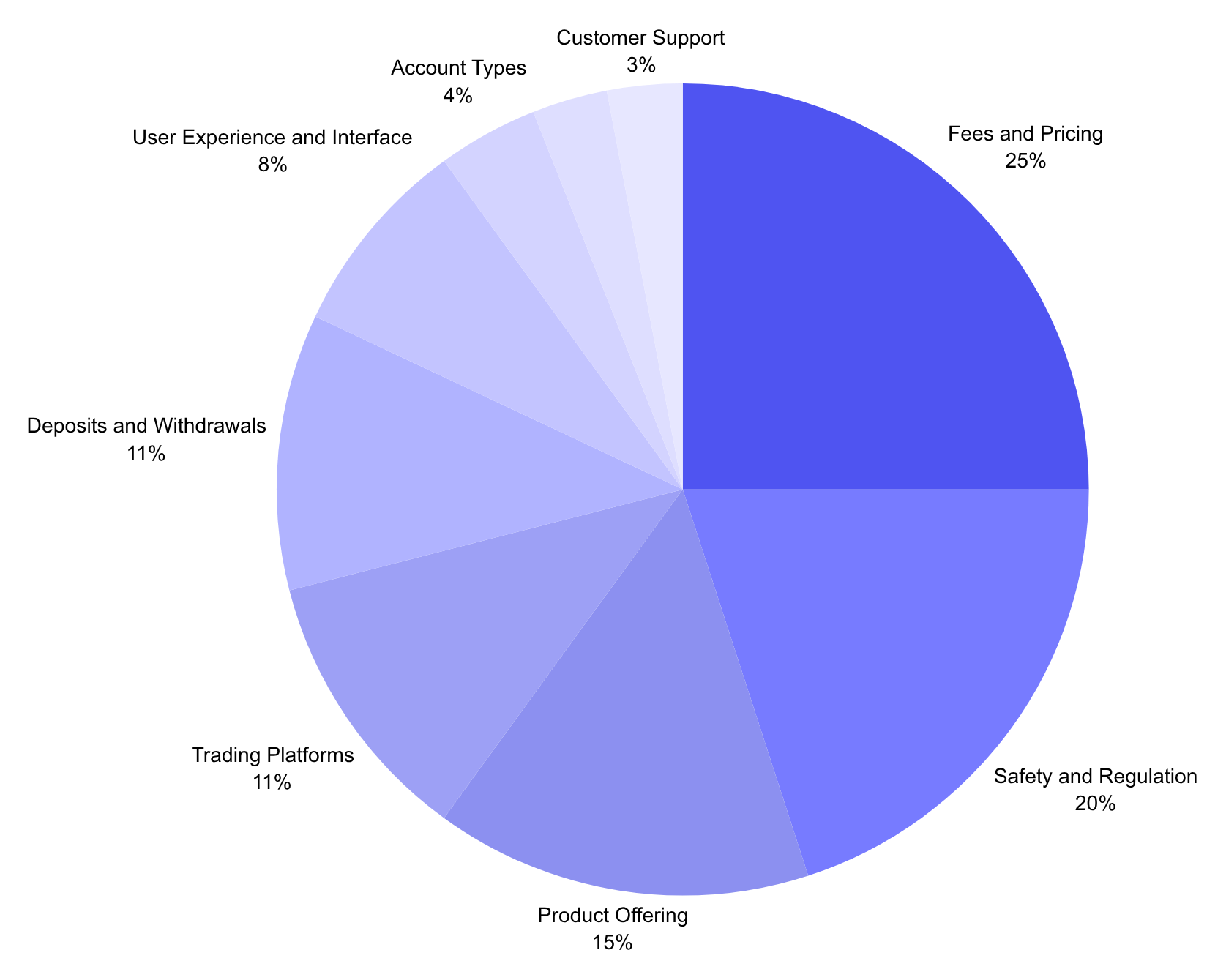

Not all factors are equal. For example, Safety and Regulation carry more weight than Education and Research. After all, safety directly impacts the protection of client funds, while education is supplementary to trading activity. Here’s a breakdown of each category’s weightage toward the overall score:

Each broker is evaluated across these categories, and every category is scored on a clear 1–5 star scale. A score of 1 reflects poor quality or serious shortcomings in that area, while a score of 5 represents excellent performance that meets or exceeds industry standards.

These individual category scores are then aggregated for the overall BrokerSpecs score. This ensures that critical aspects like safety and fees carry more influence than secondary factors such as educational content.

To maintain fair and relevant scoring, we periodically recalibrate the weightage in response to industry changes and shifting trader priorities, ensuring our ratings remain accurate and aligned with current market conditions.

We gather information from official broker disclosures, regulatory websites, platform testing, and verified user feedback. Our editorial team cross-checks broker claims against both our findings and independent sources to ensure an accurate and equitable conclusion. Each sub-criterion and data point contributes to the category score. For example, a broker may be rewarded for tight spreads and low commissions, but penalised for hidden fees, which all roll up into the “Fees and Pricing” category.

Our independence is what makes BrokerSpecs credible and enables us to operate with integrity.