At the same time, those who trade without adequate knowledge risk slipping into a dangerous game of emotions. Stumbling into a few winning trades can blind you with early profits, making it easy to get hooked on a poor strategy—or worse, trapped in an emotional roller coaster.

What is Trading?

Trading can take place across a range of time horizons—from scalping, which lasts only minutes, to swing trading, which may span several weeks.

Successful traders assess economic conditions and market sentiment, applying both fundamental and technical analysis to speculate on positions. Ultimately, trading is about anticipating price movements and making informed decisions.

To grasp how trading works in practice, it’s also important to understand bid-ask quotes and the different types of orders.

How Does Trading Work?

To begin trading, you need a brokerage account and funds for your initial capital. Once set up, you gain access to the trading instruments your broker provides.

- Open and fund a brokerage account.

- Choose an instrument, such as a stock or a currency pair.

- Place a trade using an order type, such as a market order, limit order, or stop order.

- Your order is routed to an exchange or market maker and then executed.

If your selling price is higher than your buying price, you’ve made a profit—this is called a capital gain. If your selling price is lower, you’ve taken a loss—known as a capital loss.

At first glance, it seems simple: buy low and sell high. But markets are always shifting, and the journey to becoming a consistently profitable trader takes time and discipline.

What Instruments Can You Trade?

There is a wide variety of tradable instruments, including:

- Stocks

- ETFs

- Forex

- Futures

- CFDs

- Options

These instruments have different pros and cons associated with them. The markets open at varying times across different exchanges and instruments. For example, the forex market is open 24 hours a day on weekdays, while US stocks halt regular trading hours at 4 pm EST. Though many brokers now offer overnight stock trading.

You can even gain exposure to the same underlying asset through different instruments. Whichever instrument you choose, the objective is the same, which is to make a profitable trade.

Trading Essentials

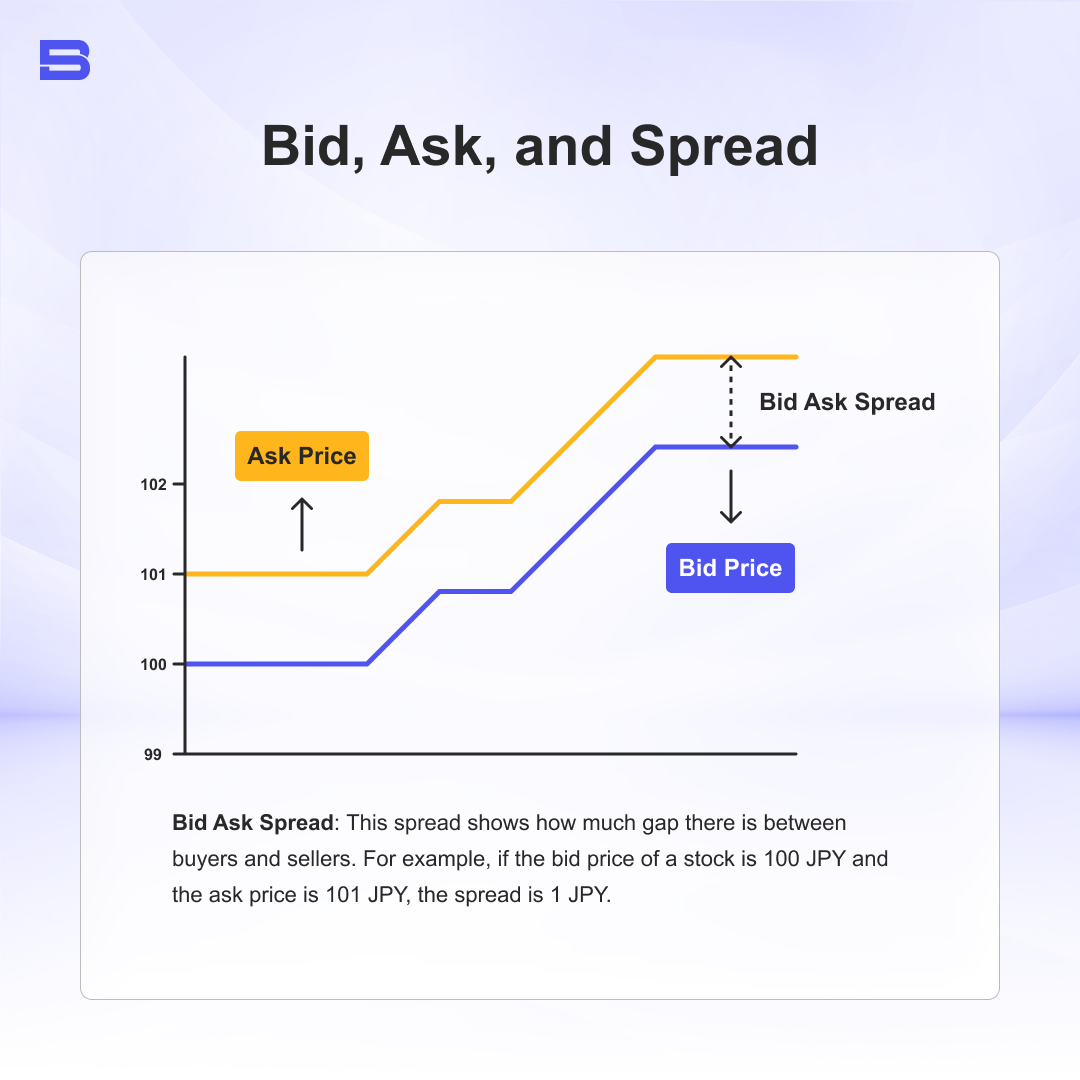

1. Quotes, Spreads, and Slippage

Here’s an example that illustrates the bid-ask spread:

2. Order Types

- Market Order: Your order is executed immediately at the best available price; prone to slippage during high volatility or low liquidity.

- Limit Order: You set the maximum buy or minimum sell price, then your order is executed at your set price or better.

- Stop/Stop-Loss: Triggers a market order when the market price hits your set price; useful to cap your losses.

Risk Management

Managing risk is essential for a trader. Without proper risk management, you won’t be able to stay in the game and capitalize on emerging opportunities in the market. You need a safety net to avoid overtrading and potentially allocating too much of your income into funding your trades.

- Manage Your Position Size: Size your trade from the stop distance and a small, fixed percent of account risk, such as 0.5–2%.

- Diversification: Traders may benefit from a diversified portfolio of assets, so one bet doesn’t sink the ship. Wise asset allocation and diversification are critical to managing risk.

- Prioritize Limit Orders: Learn to control order prices and reduce slippage costs by using the right order types.

- Use Stop-Loss Orders: Always define a maximum loss you are willing to take. This prevents emotional decision-making and protects your account from catastrophic losses.

- Keep Cash Reserves: Avoid committing 100% of your capital. Holding some cash provides flexibility to seize opportunities and cushions against drawdowns.

- Regularly Review Your Strategy: Markets change over time. Periodically reviewing and adjusting your approach ensures your strategy remains effective.

Understanding risk and reward is essential for any trader to develop a strategy. Because traders differ in goals, risk appetite, time horizon, and the amount of capital they can commit, there is no one-size-fits-all approach; your strategy should match your personal profile.

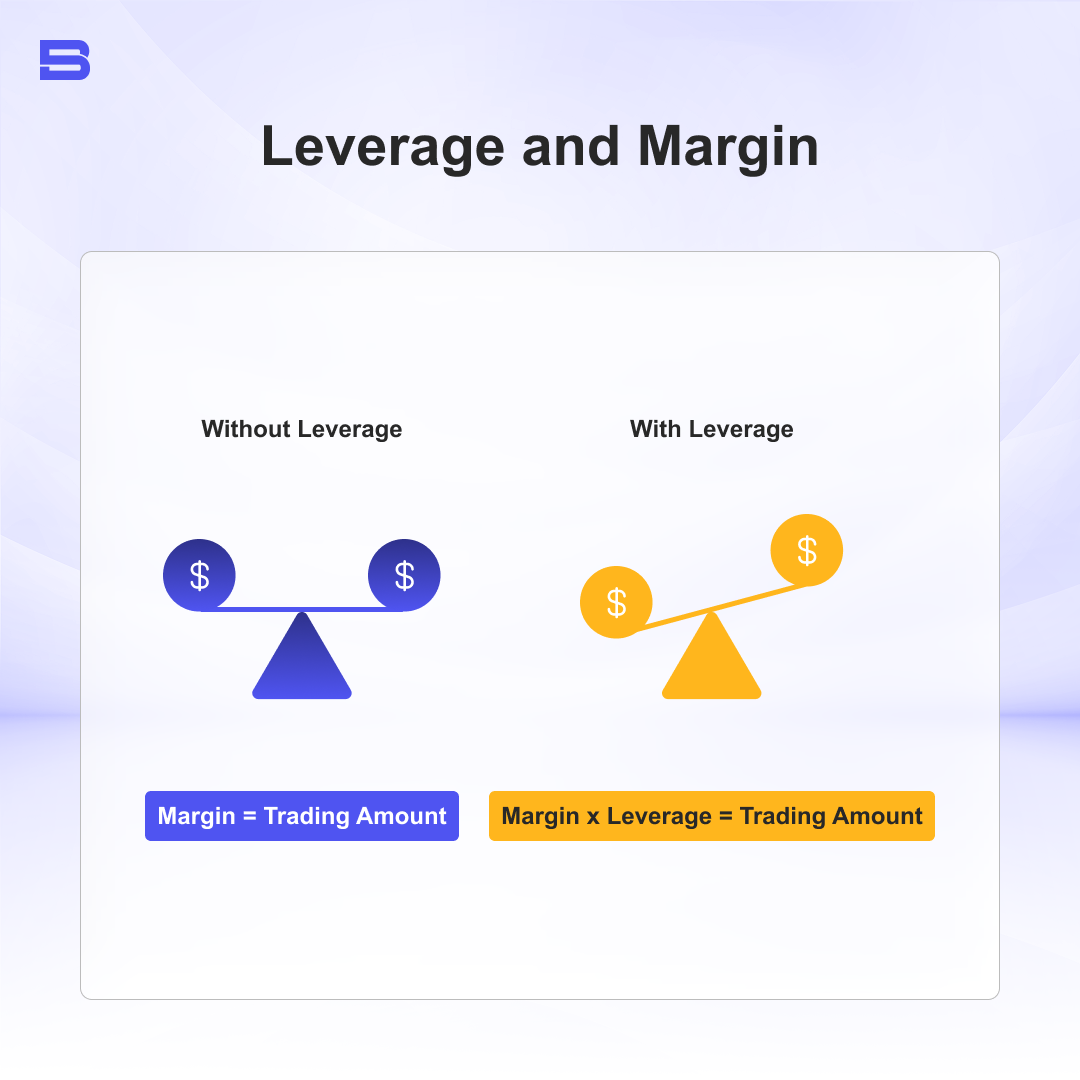

Leverage and Margin

A margin account allows you to borrow money from your broker to buy securities. This means your gains and losses are amplified through the use of leverage.

That’s the essence of leverage: even small price moves in an asset can create much larger percentage changes in your account—both upward and downward. If losses push your account close to the margin requirement, your broker may issue a margin call.

If you fail to deposit additional funds to meet the margin requirements, your broker can liquidate your assets to cover the shortfall.

Trading Costs

Trading involves several types of costs that can affect your profitability. The most common are:

- Spread: The gap between bid and ask—the smaller the spread, the cheaper the cost.

- Commissions/Platform Fees: These are the costs associated with executing orders, and they are specific to each broker.

- Financing Fees: Margin interest or overnight financing for leveraged products.

- Slippage: More prone in illiquid instruments or during high volatility.

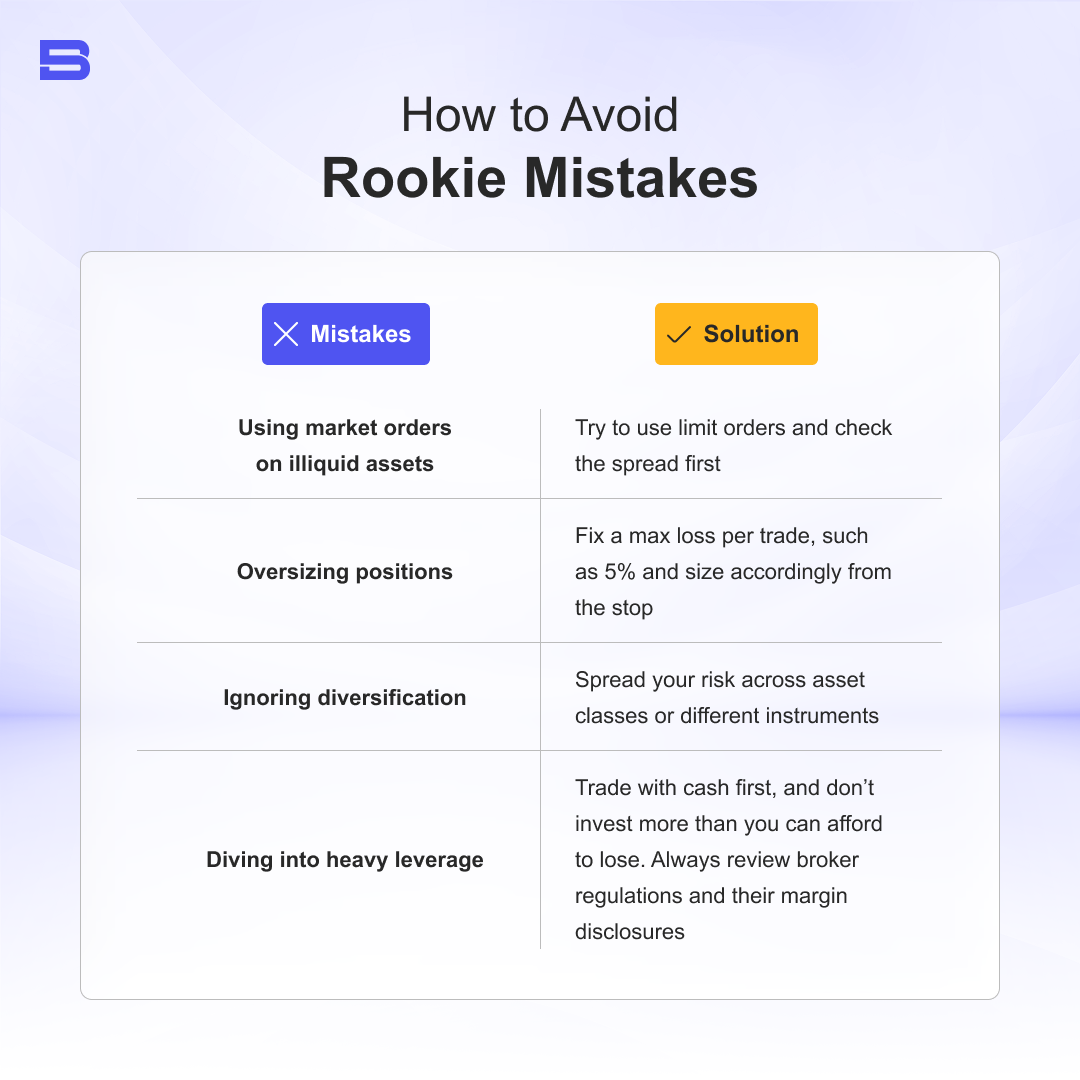

How to Avoid Rookie Mistakes in Trading

Mistakes are a natural part of learning any new skill. However, mistakes in markets can be rather costly. It’s recommended to begin testing your trades with a demo account before committing any real funds.

Note any errors in your process, and you should be able to avoid repeating them if the problem is clear. Here are some mistakes beginners tend to make, and how to circumvent them:

Before your first order is executed, you may have already made the mistake of choosing the wrong broker. Not all brokers are made equal. Some have a steep learning curve, and some should not be trusted with real funds. Novice traders can easily get overwhelmed with the vast array of options available, all claiming to be the best-in-class.

Final Word

Trading is a skill that needs refining and adjusting as market conditions change. There is no cookie-cutter strategy that will instantly give you a market edge. It’s all about finding a strategy that suits your style and risk tolerance.

Learn, practice, and document your journey constantly. Over time, you’ll develop an understanding deep enough to spot opportunities in the market and anticipate price movements with confidence.